Tesla’s Cybertruck Problem Keeps Getting Worse

Remember those million pre-orders Tesla allegedly had for the Cybertruck, according to CEO Elon Musk? It’s getting tougher and tougher for the company to explain where all of them went.

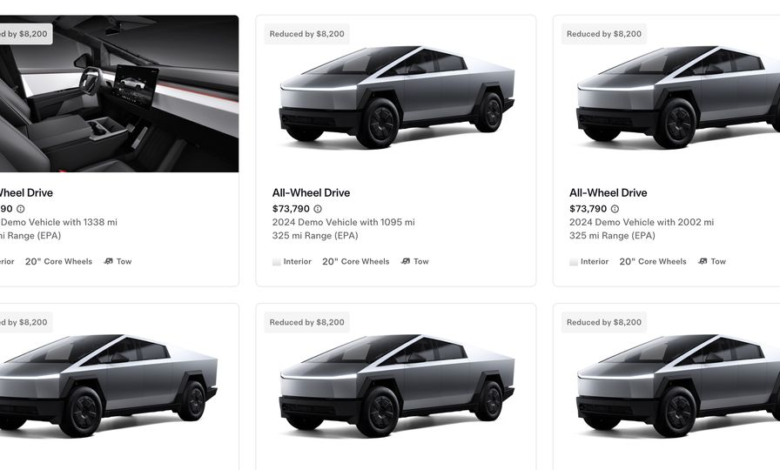

After putting around 50,000 Cybertrucks on the road, according to a recent recall filing, the company appears to be out of pre-orders and desperately looking to juice demand. Case in point: It’s now offering up to $10,000 off certain Cybertrucks it has in inventory.

That’s on the high end. While certain demo models get $10,000 off, there are far more with $8,000 or $8,200 markdowns. Notably, however, many of these are older trucks built before the Cybertruck qualified for the federal tax credit.

So even with $8,000 on the hood, these demo vehicles aren’t necessarily better deals than a brand-new Cybertruck All-Wheel Drive, which starts at $74,735 after the tax credit. If you’re willing to wait for the new cheaper Long Range, rear-wheel-drive truck, you can get one in the $64,000 range. So these 2024 trucks aren’t exactly compelling options, even at this price.

There are plenty of inventory Cybertrucks to choose from.

Photo by: InsideEVs

What’s worse, as Electrek notes, is that some of these trucks are Foundation Series trucks. Tesla stopped building those launch-edition Cybertrucks way back in October, which means it’s sitting on a significant number of flagship, first-edition EVs that are still unsold.

Given that the company previously said that it would be able to build up to 120,000 Cybertrucks per year, and that the factory is operating at far, far below that rate, this is a stunning mismatch of supply and demand. That’s why we’ve already seen incentives like free lifetime Supercharging on what was basically a brand-new product.

For a company that has always had the hot new thing, it’s starting to look like a has-been.

Of course, that’s not to say that the Cybertruck is a total failure, or that Tesla is at imminent risk of losing its U.S.-market EV primacy. The Cybertruck handily outsold all other electric pickup trucks last year, setting a record for that segment. The Model Y is the best-selling car in the world of any type, and the Model 3 is the only electric sedan that still puts real numbers on the board.

But the Model S and Model X are old—so old that they’ve already died in China—and its new flagship isn’t nearly as hot as those cars once were.

Musk, meanwhile, is making it all a lot worse, his critics and even current and former owners say. The Cybertruck is an already iconic design, but it’s also brash and showy. When you combine that with the toxicity of the Tesla brand following Musk’s increasingly unpopular political meddling, it’s a tough sell to the typical EV crowd. And since it’s electric, struggling with quality issues and not great at truck stuff, it’s not likely to win over many traditional truck buyers.

Musk would likely say he isn’t too concerned with the Cybertruck’s demand problem, as he has no interest in Tesla being a car company. He is increasingly clear that this is an AI company. For now, though, its AI pursuits are funded by a profitable and strong core business selling cars. With a billion-dollar flagship flopping and thousands of dollars in incentives going toward all of its cars, Tesla may no longer be the cash engine Musk’s master plan requires.

Contact the author: Mack.Hogan@insideevs.com.

Source link